Italy: Impressive turnaround with investors

Rome: The performance of Italian government bonds over the last year has been nothing short of remarkable. Italy’s 10-year bond has come down from a high of 4.9% in 2023 to 3.8% today, while the BTP-Bund spread has contracted from 200 basis points to 155bp. Much of this rally was towards the end of 2023, when Italy crucially avoided a move into junk territory by Moody’s.

Among portfolio managers of Italian government debt, there is belief in the economic and fiscal strategy helmed by the establishment of Italian Prime Minister Giorgia Meloni. The Meloni government succeeded that of Mario Draghi in October 2022 following the collapse of a national unity government led by the former prime minister. The political crisis that ensued led to Moody’s downgrading Italy’s outlook to negative, leaving its Baa3 rating teetering on the edge of junk status.

However, Italy’s economic resilience in 2023 led Moody’s to restore its stable outlook and leave Italy in investment grade – allowing BTPs to breathe a sigh of relief. The decision was reflected by ‘a stabilisation of prospects for the country’s economic strength, the health of its banking sector and the government’s debt dynamics’, said Moody’s. It added economic prospects continue to be supported by the implementation of Italy’s National Recovery and Resilience Plan. Italy is presently rated ‘BBB’ with a stable outlook by both Fitch Ratings and S&P Global Ratings.

The confidence in Italy was affirmed with the sovereign’s first syndication of the year, which amassed a combined order book of over €150bn across two tranches comprising a new seven-year BTP and a tap of an outstanding 30-year bond.

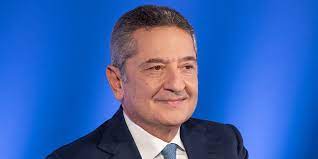

The demand is impressive but is short of a record it set in 2020. ‘It’s difficult to make a comparison as this happened during the pandemic and after the launch of the PEPP [pandemic emergency purchase programme] by [the European Central Bank] so the general context was quite different,’ said Davide Iacovoni, director general of public debt at Italy’s ministry of economy and finance. ‘However, the demand was still quite surprising for us’.

Investors are playing catch-up, Iacovoni says, ‘During the rally in rates that started since the end of October of last year, a lot of investors could not engage in the market as the books were already closed or near to be closed’. Iacovoni continues: ‘So they waited until the market reopened in January. Primary market issuances were the right opportunities for them to adjust their portfolios and cover their shorts – that with the rally in rates – had become very expensive.’

He added that the decision by Moody’s to upgrade its outlook was also a ‘positive from an Italian credit perspective’ and that ‘all these factors created a favourable environment for the issuances’.

As well as the performance of Italy’s 10-year bond, the short end of the sovereign’s curve has also compressed significantly. For instance, Italy’s one- and two-year bonds trade very closely to France and Spain’s equivalent bonds.

One question often asked of Italy is on the sustainability of its debt. Italy, after all, remains the biggest issuer in Europe at a time when the cost of funding has been going up. This is something noted by Moody’s, warning that Italy’s debt-to-gross-domestic-product ratio will remain at around 140% in the coming years, ‘while debt affordability will gradually weaken as the cost of new debt rises’.

Matthieu de Clermont, senior fixed income portfolio manager at Allianz Global Investors, is not so concerned – at least for the time being. ‘The cost of refinancing has been increasing but over the last 15 years, rates have been down so governments are still benefitting from these low rates,’ he said. ‘It will take time for the average cost of debt to increase.’

Italy is one of a few euro area sovereigns expected to increase its issuance in 2024 compared to 2023 with gross supply up from €311bn to €340bn, according to analysts at Crédit Agricole. Overall, European government bond supply in 2024 is expected to be marginally down from last year’s record with gross issuance at €1.314bn compared to €1.329bn in 2023, according to analysts at Commerzbank.

However, 2024 will be a record year for non-sovereign public sector borrower supply in Europe, with gross issuance at €420bn compared to €357bn in 2023, according to Crédit Agricole. This will be driven by a record supply of supranational issuance spearheaded by the European Union as well as higher issuance by agencies such as KfW.

The record SSA supply may cause some issues of digestion, warns de Clermont. ‘In the SSA world, if any issuer is under digestion pressure, it could be the EU, which will be by far the biggest issuer this year.’